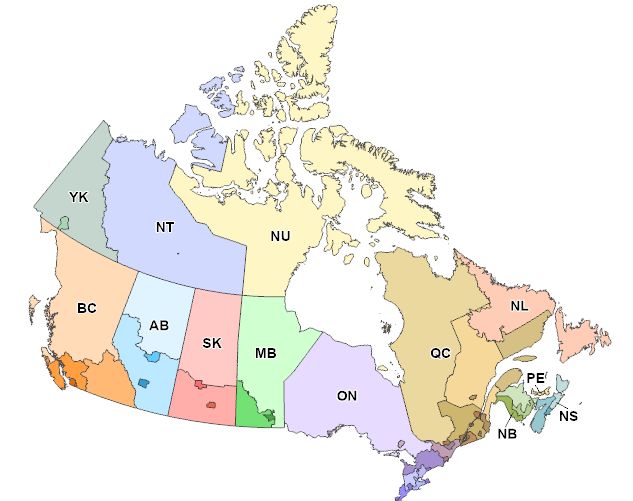

Image credit: canada.ca

Canada’s online casino market in 2025 is marked by explosive growth, regional diversity, and technological advancement, with Ontario leading the nation in both scale and innovation. This expert review uncovers provincial trends, player adoption rates, regulatory frameworks, and industry challenges endorsing peicanada.com latest article.

Ontario Dominates Canada’s iGaming Market

Ontario remains the nation’s undisputed leader in iGaming following the launch of its regulated market in 2022. In January 2025, Ontario notched CA$7.84 billion in wagers, a 31% year-over-year increase, and continues to set standards in revenue (CA$2.4 billion for the last fiscal period), active player accounts (over 1.1 million), and platform choice (over 50 licensed operators servicing 80+ gaming sites). Cities like Toronto, Ottawa, and Niagara Falls host Canada’s largest casino hubs and record the highest digital adoption, blending land-based gaming with expanding online portfolios.

Alberta, Quebec, and British Columbia: Rapid Traction & Expansion

Alberta is set to become the next major player, with a legal online casino market launching late 2025 or early 2026, poised to follow Ontario’s scalable revenue-sharing and compliance model. Quebec and British Columbia report robust growth, driven by government-operated platforms (Loto-Quebec, PlayNow), which together generate nearly $900 million annually. Localization is key: French-language games, community tournaments, and partnerships with local brands fuel engagement. British Columbia’s 7% annual iGaming revenue increase and PlayNow’s $476 million earnings illustrate the province’s competitive edge in online gambling.

Atlantic Provinces: Unified Approach with Atlantic Lottery

New Brunswick, Nova Scotia, Prince Edward Island, and Newfoundland and Labrador rely on the Atlantic Lottery Corporation (ALC) for online gambling access. The ALC’s unified system streamlines regulation, increases consumer trust, and has generated $872 million in revenue—demonstrating regional momentum despite smaller populations.

Revenue & Player Adoption Table by Province

| Province | Annual Online Casino Revenue (2025) | Key Platforms | Regulatory Status | Player Accounts |

|---|---|---|---|---|

| Ontario | $2.4 billion | 50+ operators, iGaming ON | Fully regulated | 1.1 million+ |

| British Columbia | $476 million | PlayNow | Fully regulated | High |

| Quebec | $403.9 million | Loto-Quebec | Fully regulated | Growing |

| Alberta | $179 million | Play Alberta | Regulated (expanding) | High potential |

| Atlantic Canada | $872 million | Atlantic Lottery Corp | Fully regulated | Moderate |

| Manitoba | $74.9 million | PlayNow | Regulated | Stable |

Market Trends: Technology, Localization, and Player Engagement

Provinces compete not just in numbers but in innovation. Livelier platforms feature integrated payment systems (Interac, e-wallets, crypto), AI-powered personalization, and live dealer games—all driven by local feedback and regional demand. Social engagement tools, such as chat and multiplayer tournaments, mirror the communal nature of Canadian gaming, boosting retention and trust.

Regulatory Complexity and Grey Market Competition

Canada’s provincial licensing means operators must navigate distinct compliance hurdles. Unlicensed offshore brands still compete for player traffic, prompting lawsuits and regulatory actions, such as Manitoba’s injunction against Bodog and AGCO’s pursuit of legal measures. Provinces advance consumer protections: self-exclusion programs, ad transparency rules, and peer-to-peer restrictions attract responsible players and reinforce industry credibility.

Evolving Player Preferences, Responsible Gaming & Social Impact

Player adoption is shaped by cultural, linguistic, and socioeconomic factors. Ontario leads in innovation, Alberta and BC race for market share, and Quebec’s bilingual community drives niche offerings. Enhanced responsible gaming programs, AI-driven risk analysis, and community support channels aid in minimizing harm and promoting ethical play. The push for affordable entertainment and secure experiences ensures sustained growth and increasing mainstream acceptance.

Opportunities for Affiliates and Operators: SEO & Market Penetration

-

Leverage regional keyword clusters: “Ontario online casino,” “Québec jeux d’argent en ligne,” “best Atlantic Canada casinos”

-

Publish comparison tables, hands-on platform reviews, and regulatory guides

-

Target emerging provinces: Alberta, Saskatchewan, and eastern territories represent new growth segments

-

Update content regularly with provincial news, player account stats, operator launches, and tech advancements

-

Offer responsible gambling information, multi-language support, and fast payment guides for Google E-E-A-T and user trust

The Future: What Lies Ahead for Canadian Online Casinos?

Canada’s province-by-province evolution in online gaming ensures vibrant competition and sustained growth. Ontario sets trends in regulation and tech innovation, Alberta readies for massive expansion, and smaller provinces excel through collaborative, unified approaches. With projected sector-wide growth near 10.6% CAGR and total iGaming revenue over CAD 5.55 billion, Canadian provinces stand poised to lead not only in national but global casino benchmarks.